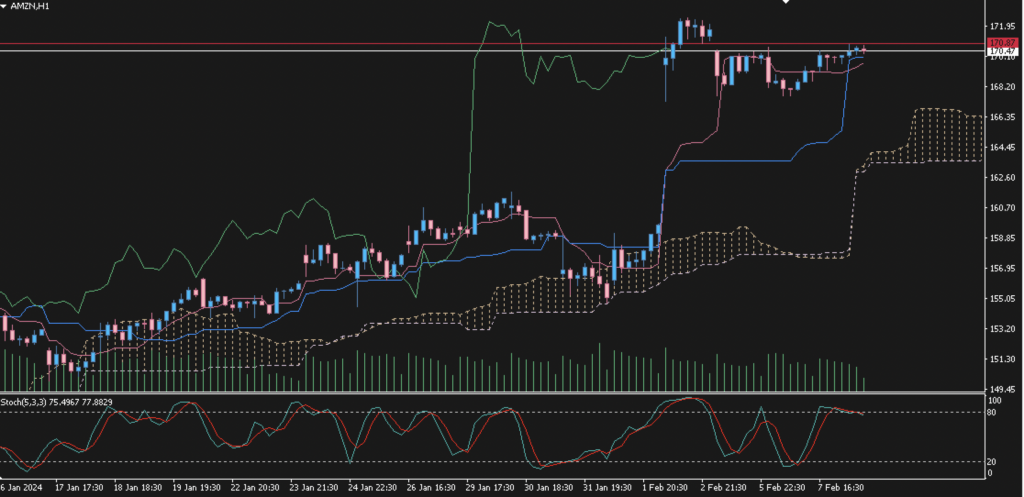

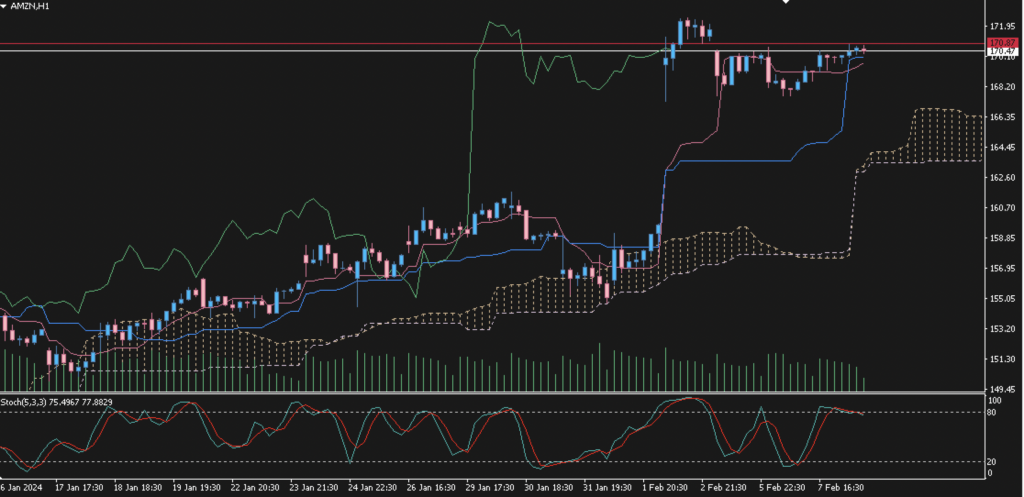

AMZN 8 Feb 2024 on the H1 timeframe, is seen to be well above the kumo cloud on the ichimoku indicator and occupies a price position of 170.47 after experiencing a significant bullish surge earlier this month. Despite experiencing a trend reversal, the stock is still sideways moving above the kumo cloud. If we refer to the stochastic indicator, it appears that AMZN has been in a saturated zone due to the overbought that occurred which allows a bearish trend to occur. Therefore, go-short could be an option for traders. However, if the stock rebounds and continues to be bullish, then go-long is an option. Keep an eye on the volatile market movements before making trading decisions.